COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

Introduction

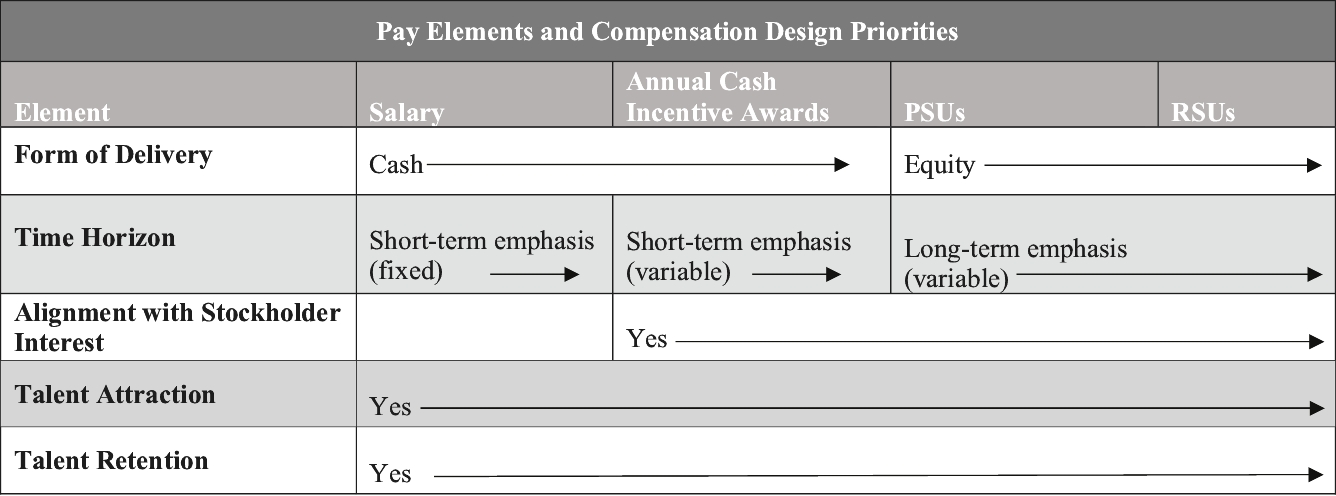

ThisIn the CD&A, describeswe describe and discuss our compensation philosophy and the material elements of our 2019 executive compensation program, applicableincluding its objectives and elements, as well as determinations made by the Compensation and Human Capital Committee regarding the compensation of our named executive officers (“NEOs”). Below is a condensed table of contents to help guide you through the NamedCD&A section of this proxy statement:

- Executive

Officers.Overview (pp 33) The- Executive Compensation Decision Making (pp 37)- Our Executive Compensation Program (pp 38) - Executive Compensation Elements (pp 39) - Executive Compensation Process and Guidelines (pp 47) Our Named Executive Officers in 2019 were:(NEOs)

Joseph Hamrock- PresidentAs of December 31, 2022, the NEOs are:

Lloyd Yates —President and CEOChief Executive Officer (“CEO”)

Donald E. Brown- Executive Vice President and CFO

Carrie J. Hightman- Brown—Executive Vice President and Chief LegalFinancial Officer (“CLO”CFO”)

Violet G. Sistovaris- Shawn Anderson—Senior Vice President Strategy and Chief Risk Officer

Melody Birmingham—Executive Vice President and President, Northern Indiana Public Service Company LLC (“NIPSCO”)Chief Innovation Officer

Pablo A. Vegas- Bill Jefferson—Executive Vice President and Chief Safety Officer

Joseph Hamrock—FormerPresident Gasand Chief Executive Officer

Pablo A. Vegas—Former Executive Vice President and Group President, Utilities

2019 Business Developments

During 2019,On March 15, 2023, we continued to execute on our established infrastructure investment-driven business strategy and remained deeply focused on our top priority- safety. We continue to invest in safety improvements, implement policies and procedures, develop technical training and guidelinesannounced a reconfiguration of leadership responsibilities for our employees and leverage new tools and technology to improve our maps, records and infrastructure performance. Importantly, we followed through on our commitment to accelerate and enhance our schedule for implementation of a Safety Management System (“SMS”) across all of our operating companies. Key developments during 2019 included:

Installing over-pressurization protection on low pressure systems across our seven-state service territory, including the completion of those upgrades in Massachusetts and Virginia.

Implementing an Incident Command Structure (ICS) aligned with Federal Emergency Management Agency standards and providing ICS training to nearly all our employees, enhancing our emergency preparedness and response capability.

Introducing a corrective action program which offers a simple way for employees and contractors to report safety concerns and supports our systematic process to review, prioritize, and track progress to reduce risk.

Training 86% of gas employees on SMS, with the completionseveral of the trainingabove named NEOs, effective March 27, 2023. Please see our annual report or our website for further details.

Our Company

NiSource is one of the rest of ourlargest fully regulated utility companies in the United States, serving approximately 3.2 million natural gas employees targeted for 2020.

Appointing an independent quality review board to oversee our safety programs.

Investing approximately $1.9 billion of capitalcustomers and 500,000 electric customers across oursix states through its local Columbia Gas and NIPSCO operating companiesbrands. Based in support of long-termMerrillville, Indiana, NiSource’s approximately 7,500 employees are focused on safely delivering reliable and affordable energy to our customers and the communities we serve.

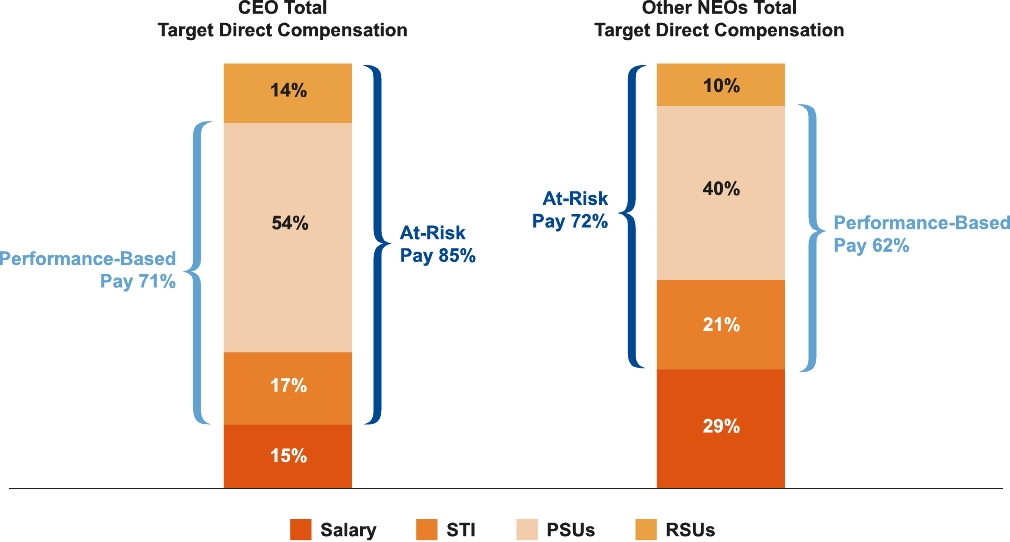

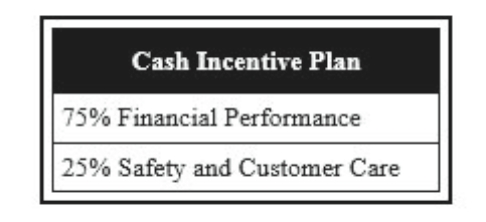

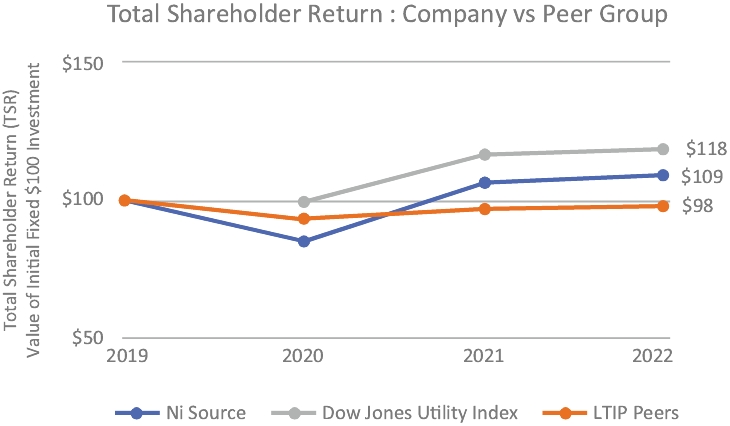

Our strategies focus on improving safety and reliability, enhancing customer service, reliabilitypursuing regulatory and legislative initiatives to increase accessibility for customers currently not on our gas and electric service, ensuring customer affordability and reducing emissions while generating sustainable returns. With our strategies in mind, NiSource is committed to providing safe and reliable energy for our customers, which in turn creates value for our stockholders. Our executive compensation program is intended to attract and communities.retain the best leadership talent in the industry. At the same time, our compensation program is designed to align our executives to achieve these critical commitments.

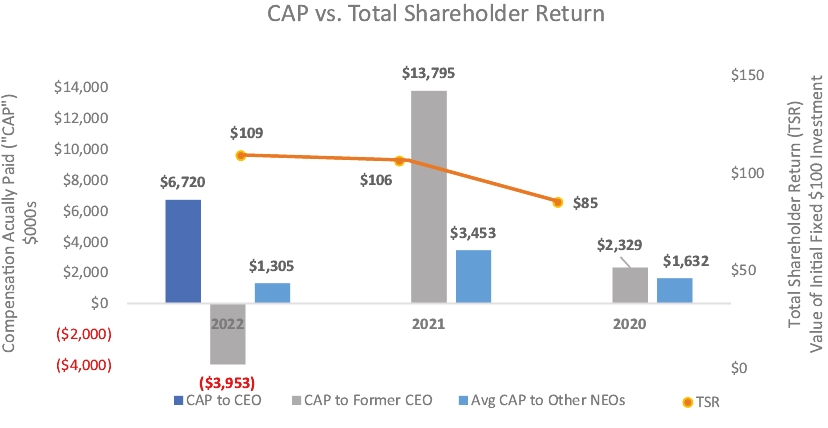

Replacing approximately 337 milesLeadership Enhancements In 2022

2022 was a year of priority gas pipelines across seven states, withcontinued transition for NiSource. Following the goalplanned retirement of enhancing gas system safetyformer CEO and reliability,president Joe Hamrock, the company appointed Lloyd Yates as CEO and reducing methane emissions.

Replacing approximately 33 miles of underground electric cablePresident, assuming these roles on February 14, 2022. Mr. Hamrock assisted in facilitating the CEO transition in a non-executive officer role and more than 1900 electric poles in Indiana to further support increased electric reliability.

Advancing our electric generation strategy in Indiana, consistent with our 2018 Integrated Resource Plan by obtaining approval for wind projects announced in 2019 and completing our Coal Combustion Residuals (CCR) capital investments.

Achieving significant industry and national recognition, including: being named to the Dow Jones Sustainability-North America Index for the sixth consecutive year; being named to the Bloomberg Gender Equality Index for the second consecutive year; listed as one of America’s Best Large Employers by Forbes magazine for the fourth consecutive year; and, once again, being named to the FTSE4Good index, an index that measures the performance of companies demonstrating strong environmental, social and governance practices.

resigned effective July 31, 2022.